iowa homestead tax credit calculator

There are additional benefits attributed to a. Warren County Assessor - 301 N Buxton St 108 Indianola IA 50125.

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Investment Rental Property Management

Equals the Net Taxable Value divided by 1000 multiplied by the Tax Levy Rate and rounded to the nearest cent.

. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. The amount of the credit is a maximum of the entire amount of tax payable on the homestead.

Credits and exemptions are applied only to annual gross net taxes total. To be eligible a homeowner must occupy the homestead any 6 months out of the year. Homestead Tax Credit Iowa residents who own and occupy their dwelling and the land it is located on may file for homestead credit.

Applicants must own and. Refer to Iowa Dept. You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028.

IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. The Military Tax Credit is an exemption intended to provide tax.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Homestead Tax Credit Iowa Code chapter 425. Homestead Tax Credit Form.

How do I estimate the net tax for a residential property with Homestead and Military Tax Credit. Other credits or exemptions may apply. Homestead Tax Credit Sign up deadline.

Iowa homestead tax credit. Iowa Homestead Tax Credit Calculator. 54-019a 121619 IOWA.

Search for your address and scroll down to Tax Credit Applications. Iowa law provides for a number of exemptions and credits including homestead credit military exemption and business property tax credit. There is a restriction of 40 acres covered under a homestead exemption in rural areas and a limit of 12 of an acre in urban areas.

Scroll down to the homestead tax credit section and click on the link that. Homeowners may qualify and sign for a. Former members of the service who have served at least 3 years.

This credit must be filed with the assessor by July 1 annually. To qualify for the credit the property owner must be. It is the property owners responsibility to apply for these as provided by law.

Iowa law provides for a number of credits and exemptions. Homestead tax credit To qualify for the credit the property owner must be a resident of Iowa and occupy the property on July 1 and for at least six months of every year. P olk County Assessor - 111 Court Ave 195 Des Moines IA 50309.

The property owner must live in the property for 6 months or. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. Dallas County Assessor -.

The current credit is equal to the actual tax levy on the first 4850 of actual valueeligibility. It is also the property owners responsibility to report to. All in all the homestead tax credit usually results in a benefit of a couple hundred dollars but if it is available to you apply for it.

For additional information and for a copy of the application please. This Property Tax Calculator is for informational use only and may not properly. In the case of a Disabled Veteran.

296 Waite Avenue S St Cloud Mn 56301 Point2 Homes Estate Homes Long House Home

Cryptocurrency Taxes What To Know For 2021 Money

Calculating Inheritance Tax Laws Com

Property Sale By Nri In India Tax Tds Rebate Repatriation Rbi Approval

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

What Are The Federal Income Tax Brackets Rates H R Block

Dependents Credits Deductions Calculator Who Can I Claim As A Dependent Turbotax

How To Calculate Sales Tax Video Lesson Transcript Study Com

Is Life Insurance Taxable Forbes Advisor

How To Calculate Basis Points Sapling Calculator Direct Marketing Things To Sell

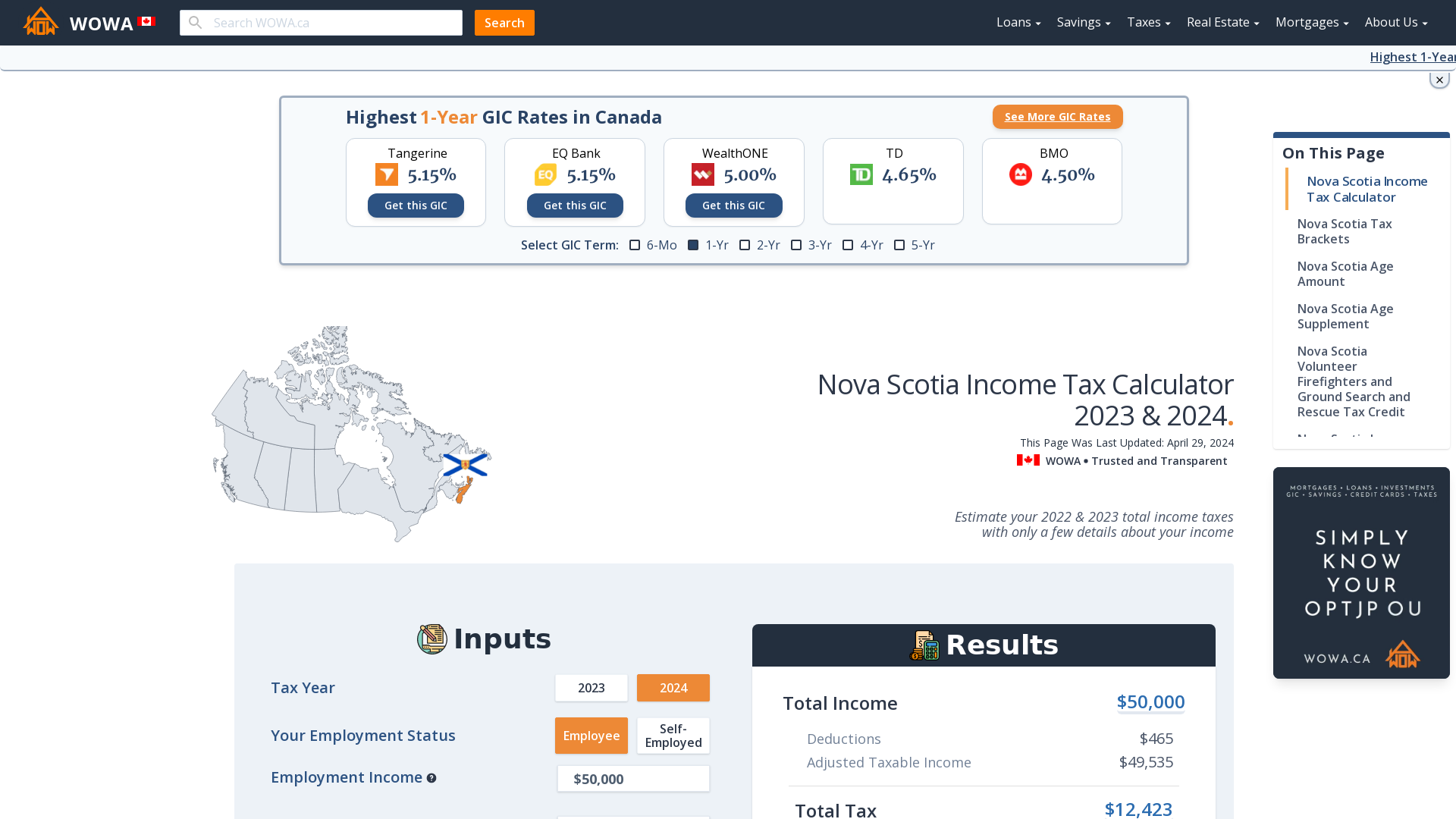

Nova Scotia Income Tax Calculator Wowa Ca

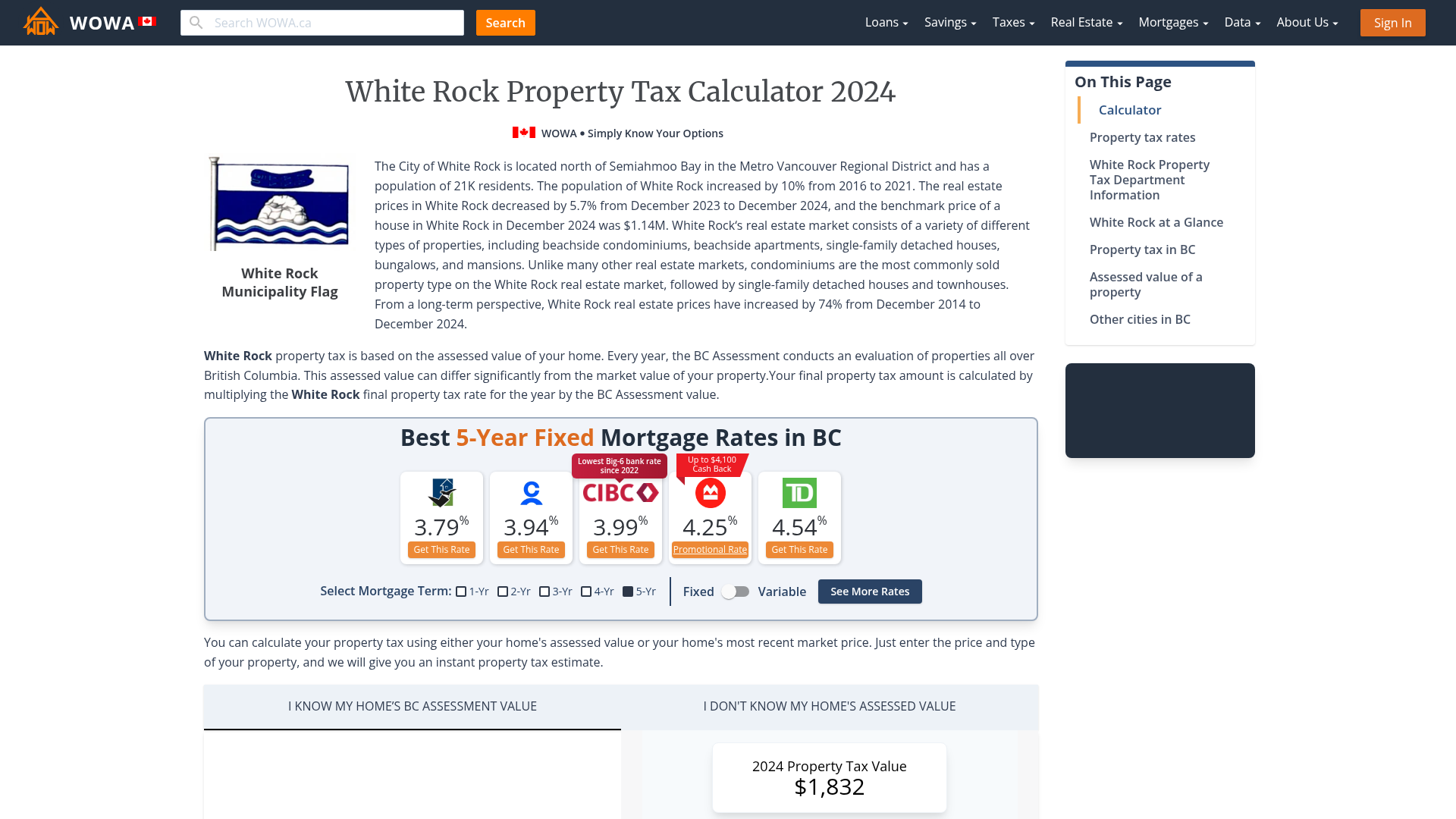

White Rock Property Tax 2021 Calculator Rates Wowa Ca

Washington Property Tax Calculator Smartasset

How Much Money Can You Inherit Tax Free Inheritance Tax Calculator Banks 2022 Daily4mative

Trulia Mortgage Center Goes Live Agbeat Mortgage Mortgage Payment Calculator Mortgage Loans

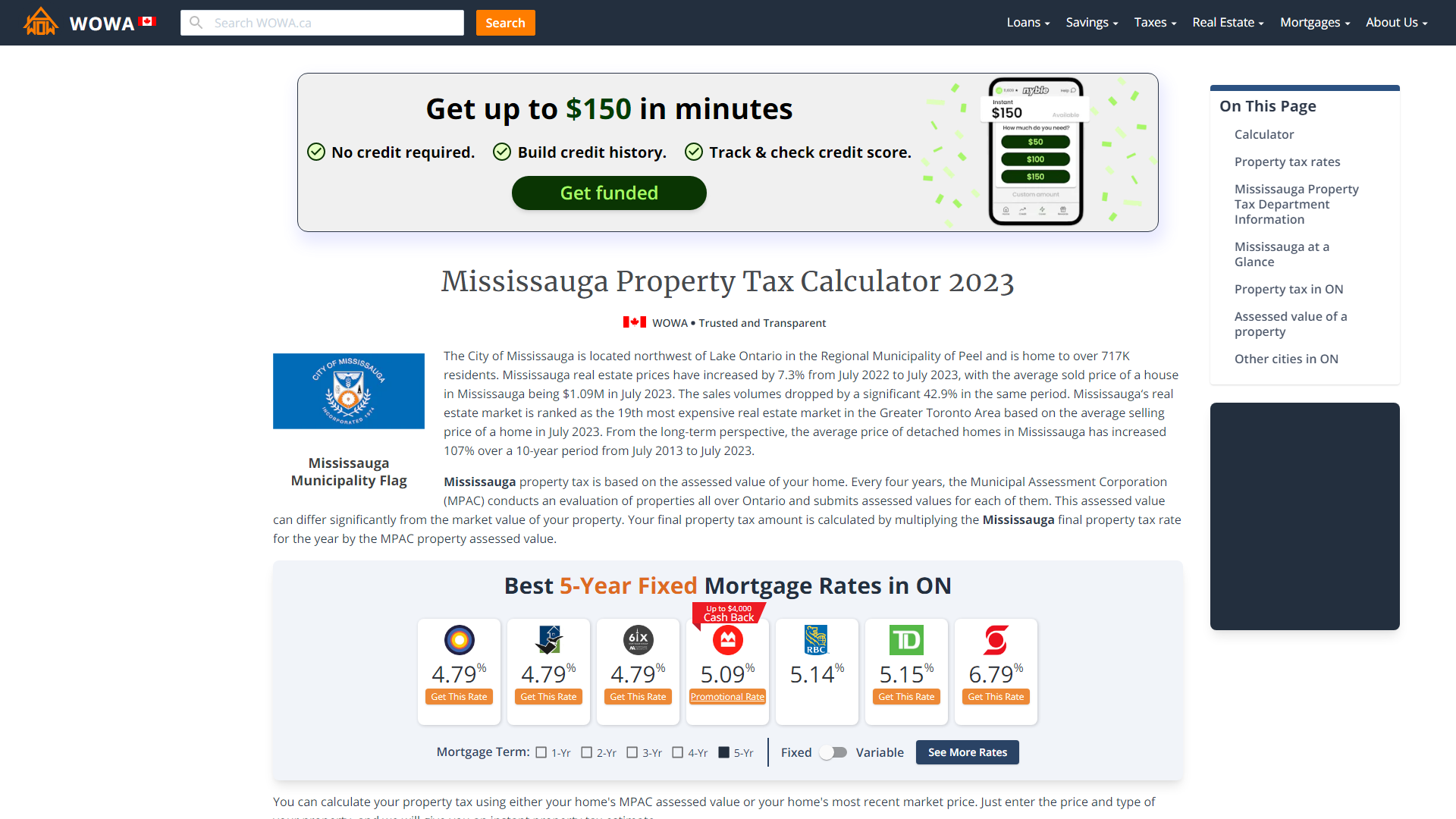

Mississauga Property Tax 2021 Calculator Rates Wowa Ca

Land Transfer Tax Calculator For Toronto Mississauga And Brampton Home Buyers Agentcashback Com